In this modern and digital-based era, we can not deny that technological advances have brought us to the next level of financial service. Blockchain technology, for example, is being implemented to support cryptocurrency involvement through banking and financing.

However, existing forms of digital assets can not be used as financial assets, therefore, can not be used as collateral, and on the other hand, asset owners need to protect their cryptocurrency in order to add value in quick time. And that's where eCoinomic takes part to solve the problem.

Introducing eCoinomic.net:

As has been said before, existing forms of digital assets can not be used as financial assets or as collateral, therefore eCoinomic.net companies try to offer new solutions through the creation of a global platform that allows individuals and small businesses to use their crypto assets. as collateral when they want to lend fiat money.

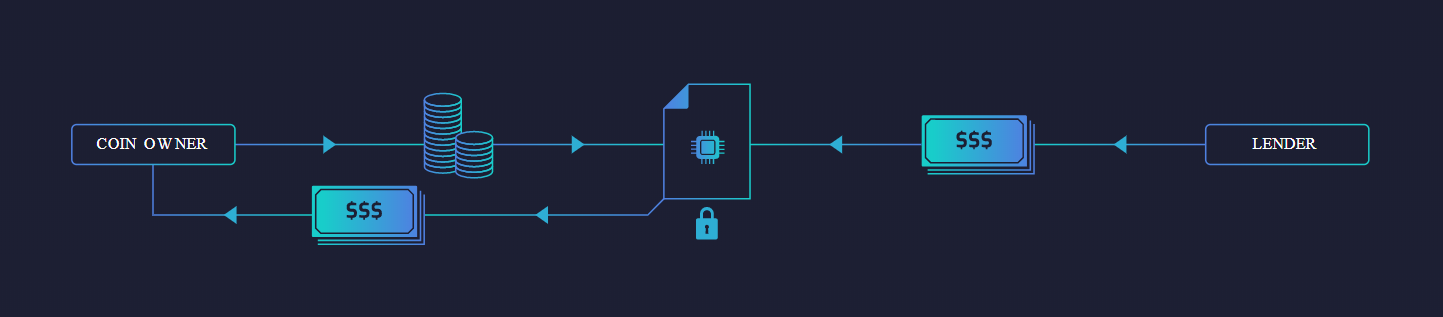

eCoinomic.net will act as a third party and will link financial institutions such as investment banks, family offices, and funds as lenders and individuals or small businesses as borrowers. eCoinomic.net will stand out in addition to the financial institution and protect it with the maximum lending procedure to minimize the risks associated with it. In addition, eCoinomic.net also offers low-risk but profitable investments for any financial institution.

ECoinomic.net ecosystem

There are two major roles in the eCoinomic.net network, Lenders and Borrowers. Lenders are financial institutions such as investment banks, family offices, or funds. They will provide loan terms in fiat currency and will be protected by eCoinomic.net with maximum lending procedures to minimize their risk. Meanwhile, the borrower may be an individual business or a small business. They need a CNC token role to use the eCoinomic.net platform.

The mechanism for accessing eCoinomic.net is quite simple. Users have to go through a registration process that requires legal KYC procedures. After that, the user must have a CNC token and add it to their new personal account. And after the eCoinomic.net launch, the CNC token price will be based on their exchange list, and the CNC token can also be used as collateral.

The main language that will be used in the eCoinomic.net platform is Python. And this platform will be based on Ethereum blockchain which will include Smart Contract program. The Smart Contract will liquidate the change from the form of the collateral into a loan and will pay the interest rate. The maximum number of single loan contracts in eCoinomic.net up to USD 10,000 and the maximum period for each user to sign their contract is for 30 days. This may be further extended after the previously charged interest and service fees have been paid by the user.

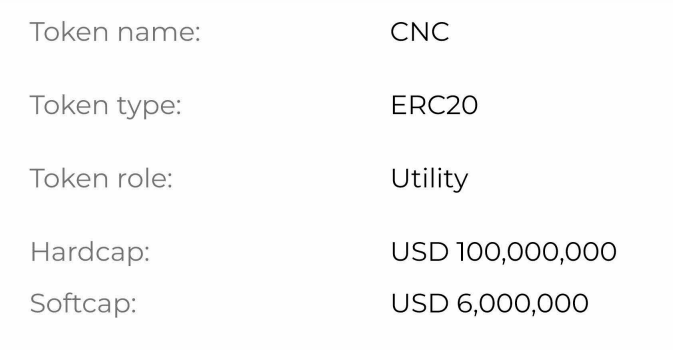

Introduce eCoinomic.net Token

Like any other platform in the world of cryptocurrency, eCoinomic.net also needs a token role that will be used to transact on its platform. The eCoinomic.net Token can be known as a CNC token. This is a utility token that can also be used as a guarantee and based on the ERC20 standard which means it is very easy to integrate with other Ethereum contracts.

Roadmap

Q3-4 2020

Conducting the IPO

Q1-2 2020

IPO procedure initialization

First stage crypto bank launch (licensed in the UK and EU)

Q3-4 2019

Cooperation and technical connection with trading platforms

Issue of bonds

Procedure of crypto bank registration start

Q1-2 2019

Finance transfers from financial institutions and family offices

Expansion through global partnership with local microfinance organizations

Legal procedures for bonds issue

Quarter 2018

Virtual cards issue

eCoinomics.net payment agent with open API launch

Platform launch - November for early adopters, December - public.

Q3 2018

Obtaining of licenses, developing solutions for different jurisdictions

Token Sale finish

Partnership with top global payment agents

Signing the Letters of Intent with financial institutions and family offices

Q2 2018

Pilot project launch in Russian Federation

Token Sale (Pre-sale stage)

International platform alpha release

Token Sale start

Q1 2018

First public information on the project

Early-stage development of the platform

2017

Origin of the idea

Conducting cryptocurrency market research, technical solutions evaluation

Working team assembly, concept development

Background

Our team has many years of experience in the real sector of economy, in working with banking and credit products.

We are aware of the obstacles to the merger of the two markets: fiat and crypto currencies. Therefore, we are planning to implement in 2018 a platform that can work in the current legal and technical framework.

2005

Legal and accounting services, financial consulting and audit.

2009

Software development and telecommunications systems services.

2010

Consulting and audit in the field of information technology; service for collecting and processing statistical data.

2012

First orders from companies in the banking sector, conducting market research, automation of business processes.

2013

Becoming a member of the group of financial companies; improvement of software products.

2015

The origin of the eCoinomic idea; conducting blockchain studies, evaluating existing cryptocurrencies.

2017

Creation of a working group, development of a platform concept and a loan product prototype.

Our Team

ADVISORS

PARTNERS

Loan collateral eCoinomic.net for owners of crypto. How does it work :

see the video

Website: https://ecoinomic.net

ANN: https://bitcointalk.org/index.php?topic=2878954

Whitepaper: https://ecoinomic.net/docs/Whitepaper_v.1_5_eng.pdf

Facebook: https://www.facebook.com/ecoinomic/

Twitter: https://twitter.com/Ecoinomicnet

Telegram: https://t.me/ecoinomicchannel

Author by: Dava.Dina

https://bitcointalk.org/index.php?action=profile;u=1034494

ETH: 0x6A9b4B19f04d46acB112fd999d8d2cD07938D3C2

Tidak ada komentar:

Posting Komentar